As the name states, an Intimation under Section 143(1) is only an Intimation and not a Scrutiny/ Assessment Order. Intimation under Section 143(1) is an auto-generated letter by the computers of the Income Tax Department without any human intrusion.

Intimation under Section 143(1) is sent only in the following 3 cases:-

- Where any tax or interest is found payable on the basis of the return after making adjustments referred to in Section 143(1) and after giving credit to the taxes and interest paid; or

- Where any tax on interest if found refundable on the basis of the return after making adjustments referred to in Section 143(1) and after giving credit to the taxes and interest paid; or

- Where adjustments referred to in Section 143(1) have been made resulting in increase/ reduction of loss declared by the assessee and no tax or interest is payable by the assessee and no tax or interest is refundable to the assessee.

The maximum time period for sending intimation under Section 143(1) is 1 year from the end of the financial year in which the income tax return is filed.

Section 143(1)(a): Communication of Proposed Adjustment

A communication for such an adjustment under Section 143(1)(a) is sent to taxpayers wherein there is a mismatch of the income/deductions/exemptions reported in the Income Tax Return and in the income/deductions/exemptions as shown in the Form 16.

This generally happens in cases where the the employee has not intimated his employer about the deductions he intends to claim and claims these deductions/exemptions himself at the time of filing of the Income Tax Return. There is no harm in claiming such deductions/exemptions in the Income Tax Return and claiming these directly in the Income Tax Return is completely legal.

Earlier, the the Income Tax Dept didn’t use to ask for the proofs for claiming such exemptions/ deductions. However, for returns filed for FY 2016-17 onwards, the income tax dept has started sending Communication of Proposed Adjustment under Section 143(1)(a) of the Income Tax Act for inconsistencies in the details as reported in the Income Tax Return and as shown in Form 16.

In such cases, the taxpayer need not get scared. This is a practical compliance only wherein you are required to intimate the income tax department – the reason for variance in the income tax return and the Form 16. The taxpayer would also be required to submit the proofs of such deductions/exemptions.

The taxpayer can reply to such a notice within 30 days of receiving such a notice. The taxpayer can send his response by logging on to his account on the website incometaxindiaefiling.gov.in and then click “e-Assessment/Proceeding” under the “e-proceeding” section. The Home Page of the website of the Income Tax Dept also says the same

The most popular reasons for such a notice is when a person claims any of the following deductions/exemptions which are not mentioned in the Form 16 but are shown in Form 26AS. These are:

- Section 80C Deductions like Tax Saving Mutual Funds, PPF Account, Life Insurance, National Savings Certificate, Tax Saving Fixed Deposit, Senior Citizen Saving Scheme, Children Education Fees etc

- Section 24 Deduction for Tax Benefit of Home Loan

- Section 80CCD Deduction for Contribution to National Pension Scheme

- Section 80E Deduction for Education Loan

- Section 80D Deduction for Medical Insurance Premium

- Section 80DD & Section 80U Deduction for Disability

- Section 80DDB Deduction for Treatment of Specified Disease

- Deduction under Section 80TTA for Interest on Savings Account

- Claiming Section 10 Exemptions like House Rent Allowance, Leave Travel Allowance etc

The above mentioned reasons are some of the most admired reasons. There could be other reasons as well for issuing such a notice. The reason for issue of notice is also mentioned in the notice which is sent.

No Intimation if No Tax Payable or Refundable

Intimation under Section 143(1) is sent by the Income Tax Department only in case any tax or interest is found payable or refundable or there is any increase/reduction in loss.

If there is no tax or interest payable or refundable on the basis of the return, or no adjustment is made resulting in reduction/increase in loss, then intimation under section 143(1) shall not be sent to the assessee.

In such a case, the ITR V Acknowledgement of filing of return of income is deemed as intimation under section 143(1).

ADJUSTMENTS TO BE MADE UNDER SECTION 143(1)

The total income or loss shall be computed after making the following adjustments:-

- Any arithmetic error in the return

- Any incorrect claim apparent from any information in the return shall mean a claim on the basis of an entry, in the return of an item:-

- which is inconsistent with another entry of the same or some other item in the income tax return.

- in respect of which, information required to be furnished to substantiate such entry, has not been furnished under this Act.

- in respect of which a deduction, where such deduction exceeds specified statutory limit which may have been expressed as monetary amount or percentage or ratio or fraction.

How to deal when you receive Intimation under Section 143(1)

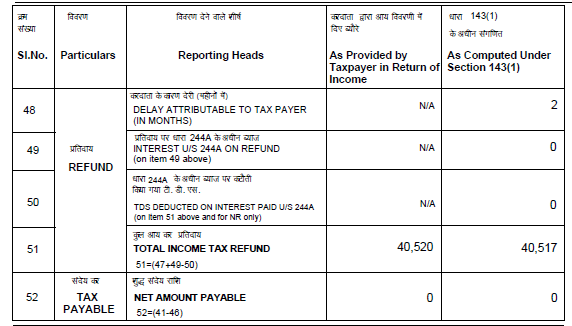

If you have received intimation under Section 143(1), you are requested to check the reason for receiving intimation. The intimation would show the income tax return as filed by you and the computation as done by the income tax department.

If you are satisfied with the computation done by the income tax department, you should pay the amount of tax payable as per Section 143(1). And in case any refund is due, you don’t have to do anything and you’ll receive the interest in the due course of time.

However, in case you are not satisfied with the computation done by the income tax department, you are requested to contact your Income Tax Officer and talk about with him the reasons for the differences.

![]()