The Goods and Service Tax Network (GSTN) has enabled the new feature to select Core Business Activity enabled on GST Portal.

Just, the Goods and Services Tax Network (i.e., GSTN) has introduced a new feature namely ‘Core Business Selection’. Vide the feature; the registered taxable person is required to select the core business activity in which they are concerned.

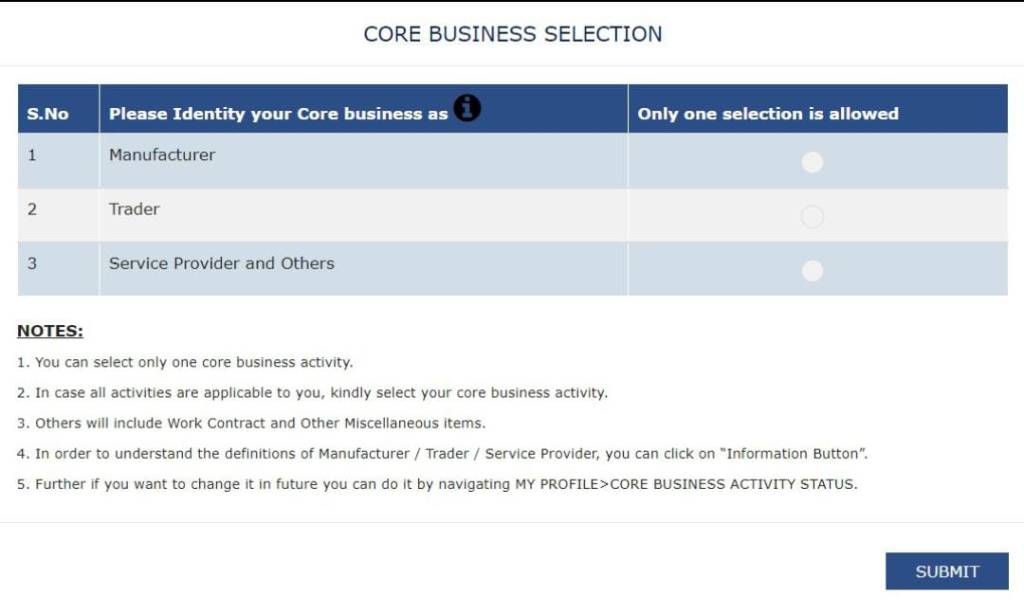

Now, if you open GST Portal you will see a new pop-up window wherein you will have to identify and select your core business as either manufacturer or trader or service provider, and others. Further only after selecting any one of the options, you will be able to login into your GST account or file a GST return, and so on. Thus selecting the option is of serious importance. The options provided on the GST portal and the notes thereto are given below:

CORE BUSINESS SELECTION

| S. No. | Please Identity your Core business as | Only one selection is allowed |

| 1. | Manufacturer |

|

| 2. | Trader |

|

| 3. | Service Provider and Others |

|

NOTES:

- You can select only one core business activity.

- In case all activities are applicable to you, kindly select your core business goings-on.

- Others will include Work Contract and Other Miscellaneous Items.

- In order to understand the definitions of Manufacturer / Trader / Service Provider, you can click on the “Information Button”.

- Further, if you want to change it in the future you can do it by navigating MY PROFILE>CORE BUSINESS ACTIVITY STATUS.

- Taxpayers are mandatory to select their business activity only once, as – Manufacturer, wholesaler/Distributor/Retailer, service providers & others post-login based on the highest turnover amongst them. You can change the same later.

For ready reference of our readers the snap of relevant window of GST Portal is given below:

Steps to avail the functionality of ‘Core Business Selection’-

The feature/ functionality will auto-flash post login on the GST website. The steps to avail the same is highlighted hereunder-

STEP 1 – Go to site https://www.gst.gov.in/.

STEP 2 – Click on the ‘Login’ icon available on the right-hand side of the site.

STEP 3 – Provide the following user credentials-

- Username;

- Password; and

- Characters mentioned in the box.

STEP 4 – Click the ‘LOGIN’ icon.

STEP 5 – ‘Core Business Selection’ will appear on clicking the ‘LOGIN’ icon. Following three options are available for selection-

- Manufacturer;

- Trader; and

- Service Provider and Others.

STEP 6 – The registered person is necessary to select any one of the above options. Selection can be done by clicking the circle available against each option.

STEP 7 – Once the option is selected, click on ‘SUBMIT’.

Some important points-

Following are some of the important points which the registered person needs to keep in mind while doing the above selection-

Selection of only one core activity is possible.

In case the registered person is engaged in more than one activity or all the activities, he is required to select only one activity which is main/ core.

The option once selected can be altered in future.

Steps to change the selected option-

In order to alter the selected option, the registered person is required to follow the below steps-

STEP 1 – Visit the GST site i.e., https://www.gst.gov.in/ and click ‘Login’.

STEP 2 – Enter Username; Password and Characters shown in the box and click ‘LOGIN’.

STEP 3 – Select ‘Dashboard’.

STEP 4 – Select ‘View Profile’ available on the right-hand side.

STEP 5 – Select ‘Core Business Activity Status’ available under the ‘Quick Links’.

STEP 6 – Select the appropriate option to change the status.

STEP 7 – Provide a reason for the change.

STEP 8 – Click on ‘SUBMIT’.

Notably, before altering the status, the registered person’s current core business activity would be displayed. In order to change the status, the registered person will be given an option to again select from the three options (i.e., Manufacturer; Trader and Service Provider and Others).

The registered person is mandatorily required to provide an appropriate reason for opting for the new status.

![]()